A few days ago Hector Finance launched their DEX. In this article, you can learn more about the exchange and how to use it.

Earlier in 2022, Hector Finance announced plans for a series of subprojects to aid the growth and development of Hector Finance’s ecosystem in the coming year. A lending and borrowing protocol, a stablecoin farming system, and a cross-chain DEX are among these subprojects. Hector Finance launched the Hector DEX following the successful deployment of the lending and borrowing protocol and stablecoin farm.

We wrote about its launch a few days ago.

The long-awaited Hector DEX is now available! This is the first big step towards our aim of general cross chain expansion and will lay the foundation for all our cross chain efforts to come.

https://t.co/5wxrHkPnxZ

DEX is in its early stages, all feedback is welcome! pic.twitter.com/NUz6SJgu8C

— Hector Finance (4,4) (@HectorDAO_HEC) March 14, 2022

Hector DEX allows users to change between tokens across different networks with a single click. It reduces the complexity and difficulties that come with bridging tokens between networks. The Hector DEX also serves as the backbone of Hector’s general cross-chain expansion. Eventually, it will allow users to work with Hector offerings from any chain as if they were natively on Fantom. This will make Hector Finance’s products accessible to a wide number of users and provide access to a larger pool of liquidity over time.

Hector DEX can save fees by assessing all available DEXs and bridges to find the most cost-effective swaps. Around 3 million users suffer with bridging and switching between chains on a regular basis. Therefore, Hector Finance has a lot of room to grow if it can solve this problem.

How to use Hector DEX?

Hector DEX is our Hector ecosystem Cross-Chain DEX Aggregator. This means that users can exchange tokens to and from HEC (and others) across different chains at the best available rates. This is one of the steps they are taking to make Hector a financial hub for the Fantom Opera Chain. Let’s look into Hector DEX.

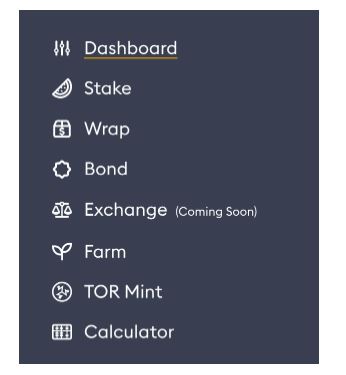

Keep in mind that you will need to enable both networks in your wallet. To go from the Avalanche Chain to the Fantom Chain, for example, you must have both chains active in your wallet. To go to the Hector DEX, you need to go to their dashboard and navigate to the “Exchange”.

SOURCE: Hector Finance

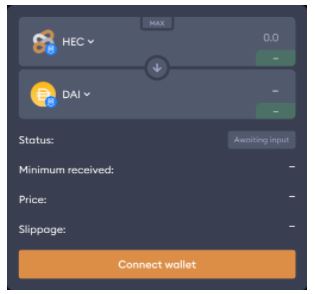

You’ll now see a swapping interface similar to the ones you already know. The top panel displays the token you’ve selected to trade. The panel below it displays the token you will receive. Take note of the little symbol next to the token icon; this represents the chain on which the token is now located. This one below is on FTM.

SOURCE: Hector Finance

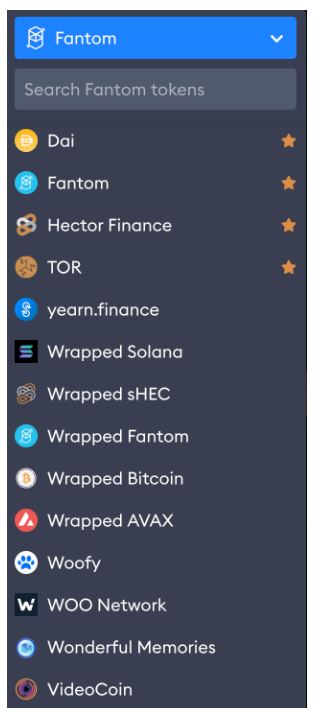

The token list is accessed by clicking the token symbol in the top panel. Using the search box, you can search for tokens. The name of the chain you’re looking at will appear at the top of this panel. By clicking there, you will be taken to the chain list.

SOURCE: Hector Finance

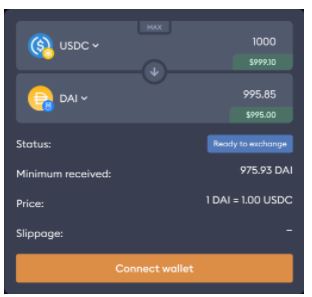

SOURCE: Hector Finance

In the top panel, enter the number of tokens you want to swap and wait for Hector DEX to find the best rates. When you’re finished, click swap. Hector DEX will perform the bridging and swapping in the background.

SOURCE: Hector Finance

About Hector Finance

Hector DAO is an OHM fork from Fantom. They want to add value to their users by establishing a variety of use cases inside the Hector Ecosystem. A part of the revenue from these use cases will be used to buy and burn Hector tokens on the market.

Hector Finance has three primary goals:

- positioning itself as a financial center to support a wide range of Fantom ecosystem use cases. They want to make managing your assets, as simple, efficient, and fast as possible

- leading to expansion of the Fantom Opera Chain by producing high-quality products and giving value

- providing long-term value to users

Hector Finance’s protocol managed treasury, protocol owned liquidity (POL), bond mechanism, and staking rewards are all designed to keep supply expansion under control. The protocol sells bonds to make money, and the treasury uses funds to mint HEC and distributes them to stakers. The protocol uses liquidity bonds for its own liquidity. They are developing numerous subprojects under the Hector Ecosystem that will generate more profit.

Moreover, for more great info, join us on Telegram to receive free trading signals.

Above all, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Finally, find the most undervalued gems, up-to-date research, and NFT buys in Altcoin Buzz Access. Join us for $99 per month starting now.