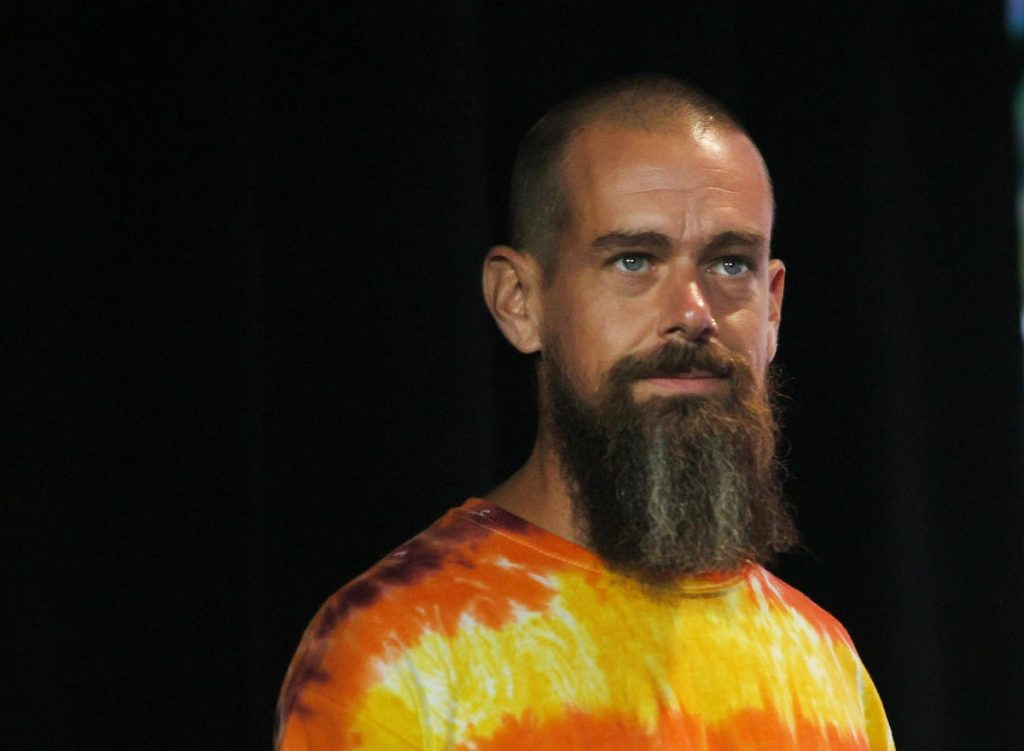

Twitter cofounder Jack Dorsey created an NFT out of his first-ever tweet, which sold for $2.9 million a year ago. In an auction this past week, the highest bid was just $280.

Getty Images

In December 2020, Jack Dorsey created a non-fungible token (NFT) out of his first-ever Twitter post. He turned a static image of a five-word tweet into a digital file stored on a blockchain, and voila, an NFT was born. A few months later, the image sold for a stunning $2.9 million. Yet in an auction this past week, no one bid more than $280 for it. And even current bids on OpenSea only amount to about $10,000, a 99% drop in value. What happened?

Dorsey’s NFT initially garnered little interest, with some people bidding a few thousand dollars in December 2020—a time when NFTs still had few believers. But in March 2021, the market entered hype mode, with monthly sales on OpenSea jumping to nearly $150 million, up from just $8 million two months prior. Iranian crypto entrepreneur Sina Estavi got swept up in the frenzy, buying Dorsey’s NFT for $2.9 million. He tells Forbes he paid such a hefty sum due to the NFT’s uniqueness and association with such a valuable company as Twitter.

While you could argue that Dorsey’s first-tweet NFT has historical significance, the $2.9 million price tag is nearly impossible to justify. The bubble price Estavi paid epitomizes the greater fool theory at work. “What is the utility of that NFT? Does Jack Dorsey take you out to dinner in Silicon Valley?” says Mitch Lacsamana, an NFT collector and head of marketing for an NFT trading group. “What is the real value proposition here? I think time has probably told us, and it’s probably nothing.”

On April 5, Estavi put the NFT up for auction for 14,969 ether, or about $50 million. Embarrassingly, no one bid more than $280. Estavi says “no one knows” why the bids came in so low. It seems that few people took it seriously. “Bidders just realized what it was–a publicity stunt. A way to get exposure,” says Blake Moser, an NFT collector who has nearly 400 NFTs. “I do think Sina Estavi accomplished what he was looking for–exposure to his NFT.”

Sina Estavi in his office in Malaysia.

Sina Estavi

Estavi has indeed gotten attention, but he seems severely out of touch with the rapidly changing NFT market. “The market isn’t ready to jump into literally anything that a celebrity or someone of high stature might release,” Lacsamana says. “I think last year was a really good time for that, but a lot of people have grown weary of cash-grab tactics.”

While the failed auction shows that NFT hype has waned, the market is still very active, with trading volume hovering between $2 to $3 billion a month on OpenSea, up from $150 million a year ago. Prices for some NFT collections like the Bored Ape Yacht Club remain near all-time highs.

Estavi’s NFT saga seems to be a case of an ill-advised $2.9 million purchase, buyer’s remorse and a new bid for attention. Estavi himself has a sketchy history. His startup, Oracle Bridge, says it will allow blockchain platforms to ingest data more easily, but today it seems to be little more than a white paper. Estavi also claims he was arrested last year in Iran and had to shut down the company for nine months while he was in prison. “They accused me of disrupting the economic system,” he says vaguely. Now he’s trying to start the company up again.

Over the past day, bids for the Dorsey tweet NFT have risen to about $10,000. Estavi says he won’t sell for anything less than $50 million.

Follow me on Twitter or LinkedIn. Check out my website. Send me a secure tip.