There is currently an overwhelming choice when it comes to decentralized finance protocols. One that has taken a slightly different approach to staking and yield farming is Prism Protocol.

Prism is a derivatives protocol that introduces new asset classes in DeFi. It essentially allows users to manage risks associated with volatility and unstable yields in a more capital-efficient manner.

Furthermore, the protocol lets users refract, or split, yield-bearing assets. This offers the following advantages:

- More leverage without liquidation risk

- Options to sell future yields for capital today

- Investing in future yield (lossless investing)

- More liquidity providing possibilities

You can now chart and analyse $yLUNA vs $pLUNA on the @prism_protocol @tradingview charts 📈

Check it out now at – https://t.co/xudoVerKzG$pLUNA proxy-governance entering testing phase imminently!$LUNA $UST $PRISM pic.twitter.com/zOS6hrtv0F

— PRISM (@prism_protocol) April 18, 2022

Refracting LUNA

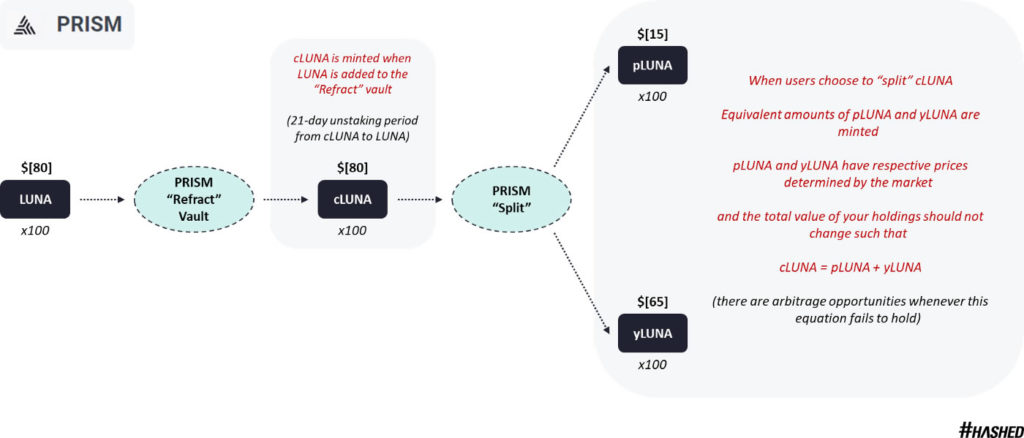

The yield-bearing assets Prism uses is LUNA, which is split into two tokens, yLuna and pLuna. Yield LUNA (yLuna) represents the yield you get for staking LUNA, while Principle LUNA (pLuna) represents the LUNA itself.

A third token called cLuna is created which can be refracted into the two above.

Furthermore, users can do separate things with their refracted LUNA tokens. One option is to mint pLuna/PRISM liquidity provider tokens. Users can stake them into the DEX as they can with cLuna. PRISM is the native token for the Prism Protocol.

Staking yLuna in Prism Farm is another way to earn yields through PRISM tokens or associated airdrops.

PRISM can also be staked to earn xPrism to be used for additional strategies on the platform. The Terra stablecoin, UST, is another asset that can be used in Prism pools.

Additionally, various Prism Protocol pools were yielding between 5.3% and 14% at the time of writing. There was $619 million in total value locked across Prism vaults and pools according to the dashboard.

It takes 21 days to swap cLuna back into LUNA due to the unstaking period for the underlying LUNA.

ICYMI: @prism_protocol is badass. Refracted LUNA is the sh*t . . . 💯

Let them make your $LUNA work for you.

Let us make it work harder ✅$cLUNA / $LUNA 🔥

💰Pool: https://t.co/2IKuNfA1pY #LoopDEX pic.twitter.com/zjqaFGGi0s

— Loop Finance 🌔 (@loop_finance) April 18, 2022

PRISM Price Outlook

The protocol’s native token had gained 9.6% on the day at the time of writing according to CoinGecko. As a result, PRISM was trading at $0.615, its highest price for five days. The token is currently down 41.7% from its March 24 all-time high of $1.06.

LUNA prices were doing even better with a 16.6% gain on the day to change hands for $89.46.

⬆️Get $125 for signing up with MEXC Exchange (FREE $25 in your MEXC wallet + 1 month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S Traders in all trading pairs and services.

Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access.

Also, For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.