by Vignesh K

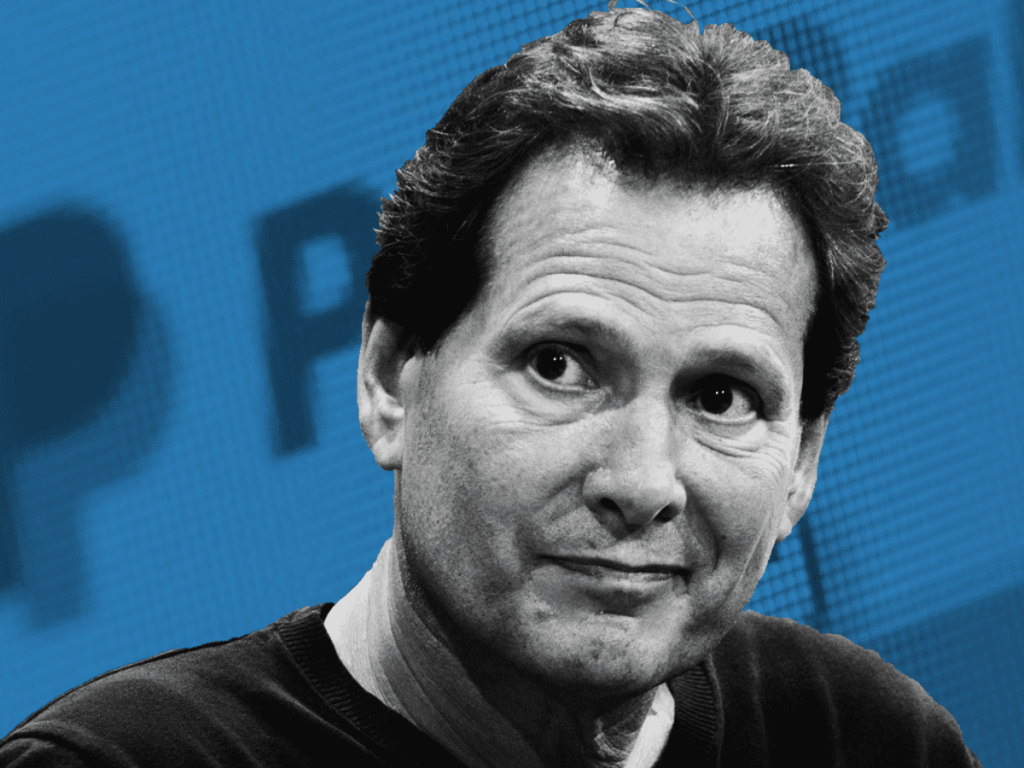

PayPal CEO Dan Schulman has reaffirmed his belief in Bitcoin, cryptocurrency, and the technology that underpins it. The CEO discussed the future of finance, digital assets, and how the two will blend in the next phase of the digital economy in a recent interview with CTech.

On March 29th, Schulman will take part in Axis Tel Avin’s event.

Over 50 investors, who head venture capital funds and representatives from firms worldwide, will debate financial innovations at this event.

In an interview with CTech, Schulman expressed his enthusiasm for the potential of Crypto and distributed ledger technology to transform the banking sector. Price action and short-term speculation about the price of BTC and other cryptocurrencies, according to the CEO, should be discarded.

In response to the objections, he stated:

“I think the initial things that everyone thinks about Crypto, buying and selling it, and what the price of bitcoin is going to be tomorrow, that’s the least interesting part about digital currencies to me. That is thinking about digital currencies as an asset class. To me, the real exciting thing about digital currencies is what kind of utility can they provide in payments.“

CBDCs (central bank digital currencies) is a contemporary financial world trend, according to Schulman. These financial institutions, which include economic behemoths like China and the European Union, are on the verge of developing digital assets or are already doing so.

In this regard, the PayPal CEO believes that combining traditional and Crypto assets would revolutionize finance. He stated,”

The intersection of CBDC, stable coins, digital wallets, and increased payment utility via cryptocurrencies is not only fascinating, but I believe it will redefine much of the financial world in the future.

PayPal’s crypto strategy

According to CTech, big corporations such as Amazon, P&G, GM Ventures, and Garmin Konnect-Volkswagen will attend the conference. Many of the attendees may be interested in learning how to integrate cryptocurrency into their business model best.

With a rise in demand from individual and institutional investors, the industry has expanded to a $2 trillion market size in less than a decade. Although some executives, developers, and investors believe the surge is due to a financial bubble, others see potential.

PayPal has been working hard to integrate Bitcoin and other cryptocurrencies into its platform since 2020. Paypal recently added a digital asset cash-out feature. Although it’s only available in a few regions right now, it has stated that it plans to expand to its millions of users.