Today we introduce you to Buffer Finance, which brings options into DeFi. As a result, an exclusive strong point of corporations entered DeFi. Also, experienced traders are part of this inner circle. They always look for ways to hedge risks or gain more exposure. This is a lot of times done with options.

Recently, there has been a steep incline of retail investors starting to trade-in options. Moreover, crypto traders have entered this new avenue of revenue. Therefore, in this article, you will discover how Buffer Finance offers options trading in DeFi.

The Crypto Retail Sector Exploited

In December 2020 Bitcoin (BTC) options crossed a $1 billion volume. In January 2022, that is already a multi-day volume.

There are a few reasons for this explosive growth of retail investors in options. For example, plenty of easy-to-use trading apps, like Buffer Finance, are available. Furthermore, there is more social media exposure about this kind of trading.

Source: Buffer Finance

What is Buffer Finance?

Buffer Finance is a non-custodial, on-chain, peer-to-pool options trading protocol. With their investment theory, Buffer revolutionizes options trading. They issue customizable options. In turn, they collateralize these against a liquidity pool.

Also, Buffer Finance manages all liquidity pools with smart contracts. As a result, there is no need for a counterparty (option writer). Here is what Buffer Finance also does as a DEX.

- Decentralizes and simplifies trading.

- Increases the accessibility of options trading.

- Only DEX to allow BNB options trading.

However, there are some challenges that Buffer Finance needs to solve. Traditional options trading takes place at CEXs or OTC (over the counter). OTC are private transactions without an intermediate party. In other words, a direct transaction between buyers and sellers.

But, there are some flaws in both these set-ups. These are exactly the problems that Buffer Finance wants to solve.

- Formal exchanges or clearing houses: Centralization. You can’t customize it the way you want it.

- OTC: Default risk.

Centralized Platforms

A CEX, or a platform like Deribit, brings options buyers and sellers together. However, every time somebody wants to buy an option, somebody else needs to issue an option. Moreover, buyers need to pay an option premium when buying an option. As a result, issuing options can be an interesting financial activity.

But, there is also a risk. As such, options trading is a complicated process. Therefore, traders need the correct knowledge of options and the assets they represent.

Buffer Finance has liquidity pools. That’s how they solve this problem. They bundle the risks of all written option contracts. This spreads the risks between all liquidity providers. As a result, options issuers no longer need deep knowledge about options trading.

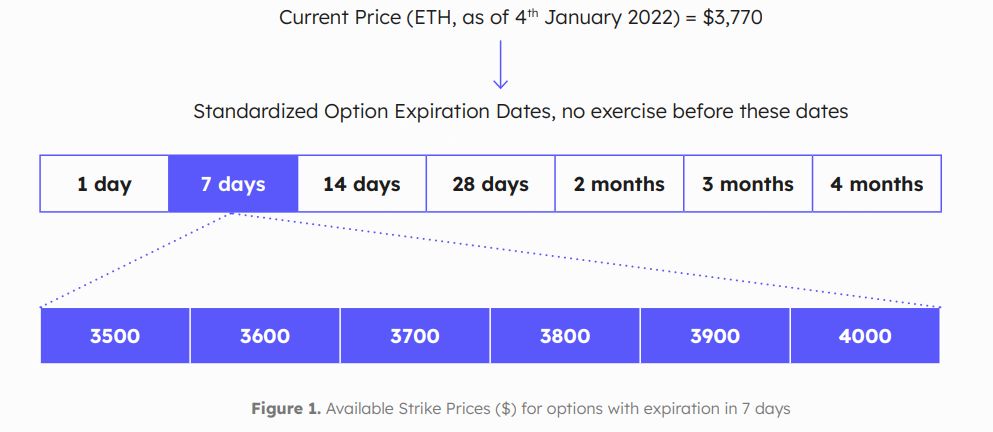

Non-customisable

Middlemen enable most of the options trading. They charge hefty fees and have everything in a mold. For example, the Deribit platform offers only “European style” options. In other words, you can only use them on the expiry date. On the other hand, Buffer Finance offers more options. They customize their options, and this has two advantages.

- An arbitrary setting of a strike price.

- They offer “American-style” options. You can exercise these at any time before they expire.

By using this flexibility, they recognize that with options, there is no ‘one size fits all’. As a result, this gives more control over transactions and products.

The picture below shows how other exchanges don’t offer customizable options. They have everything set and there is no flexibility.

Source: Lithium Buffer report

Default Risk

OTC may look like a suitable alternative when you want to customize options. However, OTC brings its sets of risks to the trading table. As a result, OTC transactions lack a few things.

- Rules.

- Regulations.

- Transparency.

- No guarantee that the counterparty will follow through.

In options trading, this is when the CEXs or clearing houses perform their duty. They fulfill the contracts and remove counterparty risks. In addition, OTC transactions are not flexible. It is difficult to replace a counterparty if needed.

However, Buffer Finance offers a trustless solution. This combines the best of both worlds.

- Custom solutions as in OTC trading.

- Default protection and security of a CEX.

Buffer Finance Key Advantage Challenges

Buffer Finance’s vision is to keep expanding and building the DeFi ecosystem. Their liquidity pool protocols solve many existing problems. As a result, they are the only DEX that offers BNB options trading.

1. Key Advantages

With the help of their liquidity pools, Buffer Finance manages a few things:

- They diversify issuer risk.

- Buffer can offer more flexible option contracts. Especially compared to traditional clearing houses.

- They assure safeguards that OTC transactions lack. Blockchain technology makes it easy to scale the liquidity pools. Transparency is the main part of this technology! This should solve any trust issues.

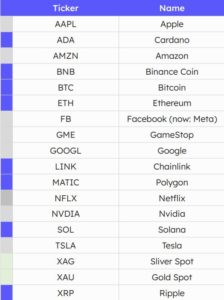

- Buffer Finance offers a variety of products. They offer equities (gray), cryptos (blue), and commodities (green). See the picture below.

- Gamification of options trading. As a result, you don’t need in-depth knowledge. Options trading just became a prediction game.

Source: Lithium Buffer report

2. Key Challenges

Buffer Finance is also subject to some challenges.

- Option mispricing. This is a typical risk of option issuers.

- Capital withdrawals.

- Token/currency risk.

Finally, to give you an idea of how to price options, have a look at the following video. This will help you to price options correctly.

There is a combination of three elements that determine option prices. The video explains these three elements. Nonetheless, here is a short recap.

- At 0:20 the difference between call options (price goes up) and put options (price goes down).

- 0:39 talks about the three elements that are at the base of the option price of an underlying asset.

- 2:35 Explains the relation of the price of the underlying asset and the strike price. That’s when you want to sell.

- 3:40 A sample of a 30-day expiration. It also explains how the price of an asset and an option moves.

- From 5:52 onwards, explains the volatility. How asset prices swing and the effect it has.

Volatility causes (2) capital withdrawal risk and also (3) token risk. Although they are relevant to Buffer, all investors should be aware of these risks before investing.

The Buffer Finance Token Ecosystem

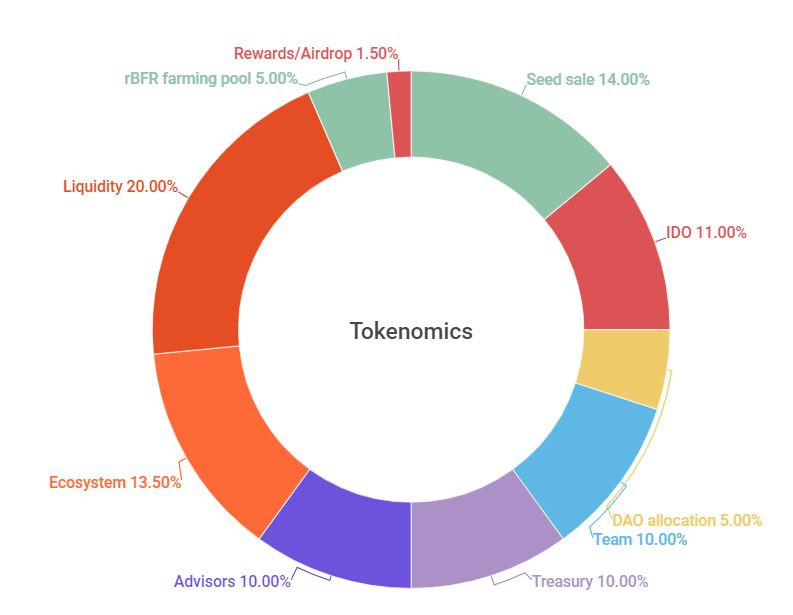

Buffer Finance has three different tokens in its ecosystem. Each token has a different utility and benefit.

- iBFR token—This is also the native token. Stake iBFR to farm the BFR token. Stakers receive 50% of the revenue generated by the protocol.

Also, at the time of writing, the price of iBFR is $0.0636. There are 100 million iBFR in its total supply, with 7.24 million in circulation. This gives a market cap of $460,000. BFR reached an ATH in December 2021 of $0.854131. The picture below shows the iBFR distribution.

Source: Buffet Medium

2. BFR token—Buffer’s uncapped token. Buffer uses this for perpetual revenue-earning. The token price increases with token supply. Holders receive 100% of all settlement fees and reflection rewards on buy and sell.

3. rBFR token—This is the token that liquidity providers receive. rBFR earns yield over provided liquidity. It gives right on option premiums paid by option buyers. It is also possible to stake this token. The reward is in iBFR.

You can mint rBFR by providing liquidity as an LP. Consequently, stake rBFR and receive iBFR. Now, stake the iBFR again and farm BFR. This cycle allows you to get the most yield out of the three tokens.

Conclusion

Buffer Finance decentralizes and simplifies options trading. Furthermore, they increase the accessibility of options trading. They are a pioneer in the decentralized derivatives market. As a result, they play an important part in DeFi’s development. For this process to happen, a developed derivatives’ ecosystem is vital.

Finally, DeFi is growing, and so will the decentralized derivatives market. Certainly, Buffer Finance is in the correct position to profit from these developments. So far, Buffer sold over 400 options with a total size above 2500 BNB. Testnets are running on Avalanche and also on Polygon. They are about to launch their mainnet. The future is looking bright for Buffer Finance.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.