- Marvell Technology dumps over 16% after Q2 earnings.

- Marvell missed Q2 revenue projections, but Wall Street is more concerned with Q3 outlook.

- Michigan Consumer Sentiment and Expectations miss forecasts.

- As Wall Street cuts price targets, MRVL could sink back to $48.

Marvell Technology (MRVL) had a solid quarter. But you wouldn’t know that from the over 16% drop in its share price on Friday.

The 30-year-old semiconductor company, valued for its AI system-on-a-chip (SoC) integrated circuits used in artificial intelligence (AI) applications, reported adjusted earnings per share (EPS) of $0.67, in-line with Wall Street consensus, and revenue of $2.01 billion that rose more than 57% from a year earlier.

But the fact that revenue missed the Street’s heady estimates by $10 million and Q3 guidance left a lot to be desired led traders to call it yet another sign that the AI rally is slowing down.

Wednesday’s Nvidia earnings also offered a miss on data center revenues, pushing that leading AI company’s shares down 3% at the time of writing. On Friday, Alibaba (BABA) added insult to injury by announcing that it had developed an AI inference chip to compete with Nvidia’s H20 GPU, which Chinese authorities view as an inferior product to the H200 chip that Washington has barred from export to China. BABA stock surged more than 13% on the news.

Though core Personal Consumption Expenditures (PCE) for July came in-line with expectations, meaning the Federal Reserve (Fed) is now considered more likely to cut interest rates in September, the market chose to focus on the poor results from the University of Michigan’s Consumer Expectations and Consumer Sentiment indices instead.

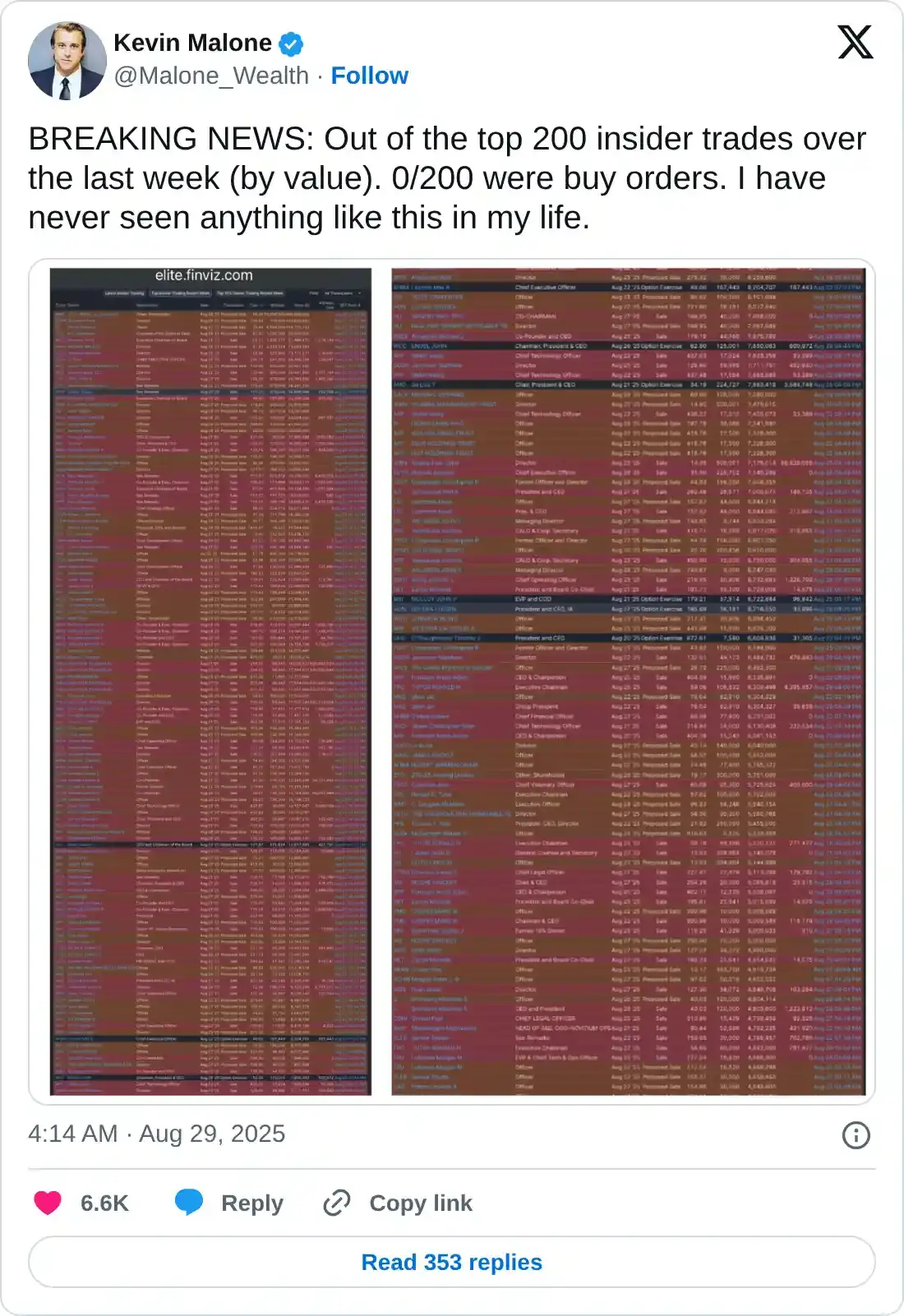

The NASDAQ Composite slumped some 1.2% by the afternoon, and the S&P 500 has slid 0.7%. Many observers are pointing to a large quantity of insiders taking money off the table:

@Malone_Wealth post on X.com from August 29, 2025

Marvell Technology earnings bode poorly for September

“Lumpiness” was the word that analysts used to describe Marvell’s business prospects for the second half of the year.

Bank of America Securities analyst Vivek Arya said that “the same level of confidence/visibility” on Marvell’s AI guidance was no where in sight. The company guided for a midpoint of $2.06 billion in Q3 revenue, while Wall Street was expecting $2.1 billion.

As a result, Arya cut his 2026 data center growth estimate to mid-teens on an annual basis from his 23-25% prior view. Bank of America cut its price target from $90 to $78, which is still well above the $64 level that the stock is garnering on Friday.

Needham analyst N. Quinn Bolton said that Marvell’s custom chips designed for Microsoft (MSFT) and Amazon (AMZN) might be pushed to Q4, meaning that Q3 could see a quarterly 15% decline from Q2 in custom silicon.

Data center revenue grew 3.5% QoQ compared with the 5% run a quarter ago and the 25% clip witnessed three quarters earlier.

While Marvell is projecting $0.74 in adjusted EPS for Q3, analysts don’t think it’s much of a jump from the $0.73 consensus figure. Basically, Marvell is continuing to see a measurable expansion of its business, but this is just not enough growth compared with what the market desires.

Marvell Technology stock forecast

Marvel stock shot below both the 50-day and 100-day Simple Moving Averages (SMAs) on Friday. This is a poor sign heading into September, which has historically been a lackluster month for market gains. The 200-day SMA was already a notable overhang on the stock, sitting as it was above $83, owing to the January all-time high above $127.

Traders will now look to the 161.8% reverse Fibo Retracement at $58.20 for support. A break there would likely send MRVL down to its April support structure circa $48. Bulls now have the difficult task of pushing Marvell stock above the 50-day, now trading in the $74s, in order to put an end to this bearish picture.

MRVL daily stock chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.