TikTok’s U.S. future might be secured, but the app isn’t out of the woods just yet.

When TikTok confirmed its U.S.-China deal was completed on Jan. 22, it felt like the five-year-long battle had finally come to an end. But under its new majority American-owned entity, TikTok USDS Joint Venture, app outages, changes to its privacy policy, as well as concerns about the company censoring politically sensitive content, have already sparked backlash and worry among its users and creators.

Here are five charts detailing why TikTok’s existence in the U.S. under new ownership, isn’t as smooth sailing as it hoped, at least not yet.

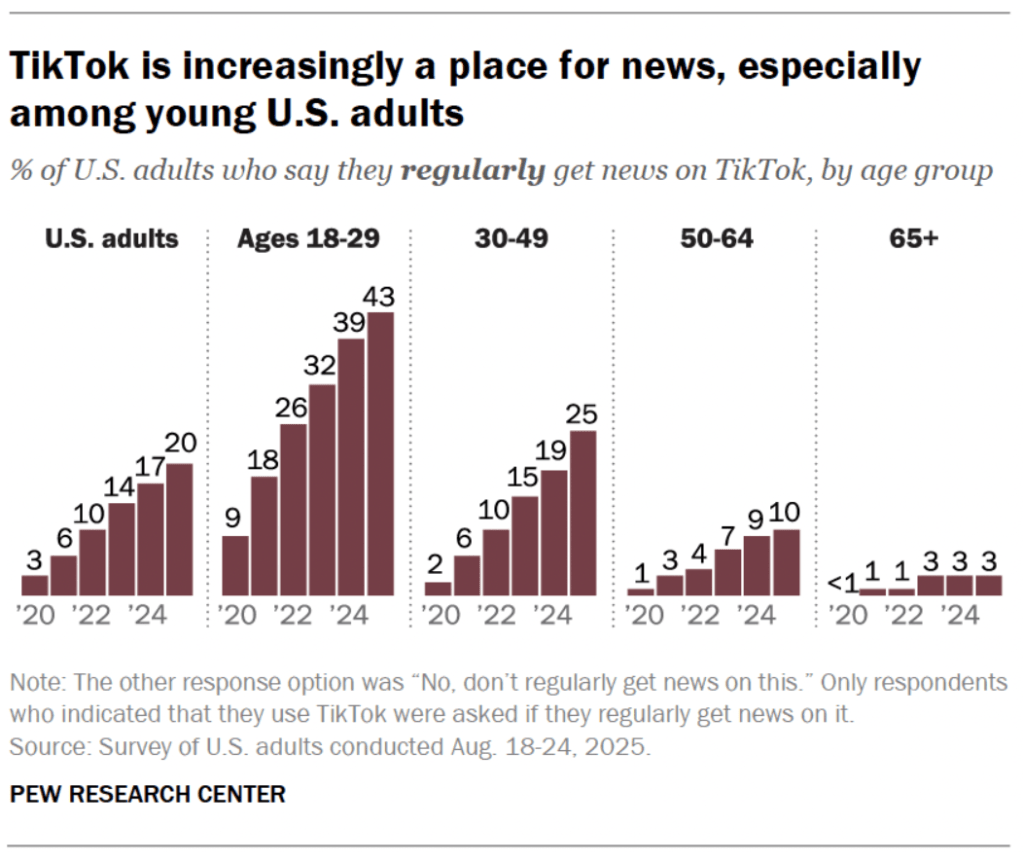

TikTok is a top app for U.S. young adults to find news

Last year, research from Pew Research Center found that 43% of U.S. adults under 30 (18 to 29) now regularly get their news from TikTok, up from 9% since 2020. Even a quarter (25%) of adults between the ages of 30 to 49 said they regularly get news from the entertainment app, up from only 2% in 2020.

Which is to say that TikTok’s main audience is aware of what’s transpired regarding its U.S. ownership deal, and the subsequent perspectives on changes to its privacy policy, through the content shown in their For You Pages.

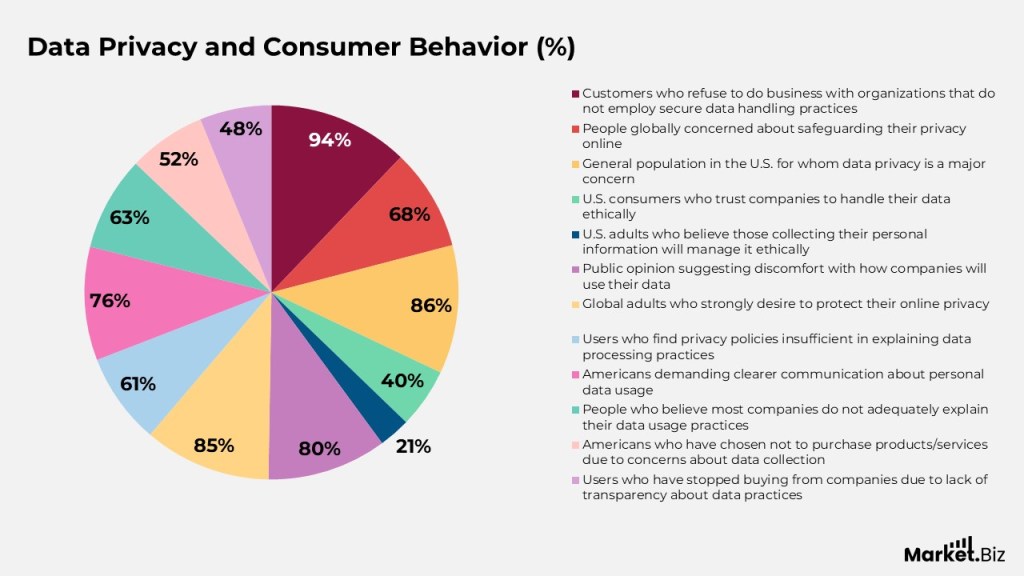

Consumers are far more concerned with data privacy than they ever were

When it comes to privacy, there’s always the issue around consumer trust. Namely that nowadays consumers are very aware that platforms, retailers, et al, collect their data. Why? There’s a huge difference between sharing data, and surveillance.

This graph from Market.biz illustrates that clearly.

According to the chart, 94% of customers refuse to do business with organizations that do not employ secure data handling practices. Moreover, for 86% of the U.S. population, data privacy is a concern.

Added to that, 85% of adults globally strongly desire to protect their online privacy, while 80% public feel uncomfortable with how companies will use their data.

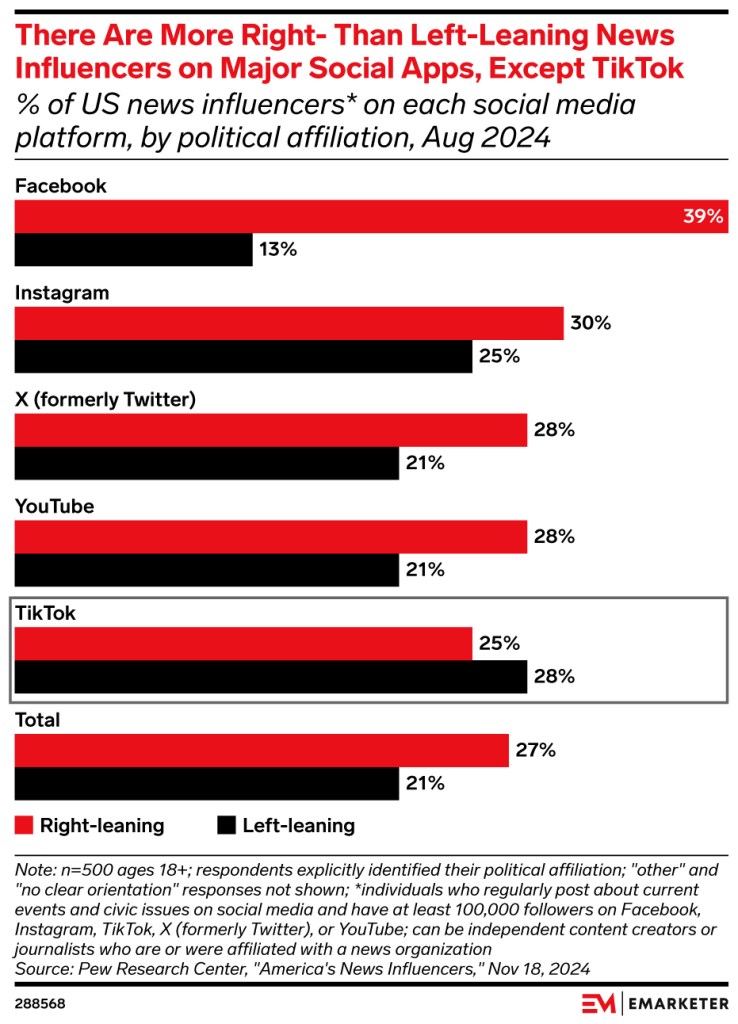

More left-leaning than right-leaning users on TikTok

Unlike the other platforms which show the opposite trend, there are more left-leaning (28% democratic) than right-leaning (25% republican) users on TikTok, that is according to eMarketer, citing data a couple of months prior to the U.S. presidential election in November 2024.

Which makes sense then why the users were on board with President Trump saving the app. But it also makes sense why those same users wouldn’t be on board with the latest updates to its privacy policy, which read more like a surveillance tactic than general collection of user data.

U.S. app uninstalls hit an all-time high

Following TikTok’s changes to its privacy policy in the U.S., users and creators across Threads, X and elsewhere on the web were already claiming they’d either deleted their account, or were considering leaving as result.

Data from Sensor Tower showed that daily average app uninstalls for TikTok in the U.S. between Jan. 22 and Jan. 28 increased 195%, compared to the previous 90 days.

And while uninstall rates started to decline from Jan. 29, they still remain at historically higher levels than before. At the same time, Instagram uninstalls remain consistently low.

Platform peers are waiting to take TikTok’s users/creators and subsequently advertisers

It’s common knowledge that when one platform is having a turbulent time, the others typically try to capitalize on it. As we saw around the time TikTok experienced its 14-hour blackout in January 2025.

During that period, Snapchat, YouTube and even Pinterest were doing what they could to sweep up those ad dollars, and advertisers had contingency plans, should the app disappear altogether.

Outages aside, that typically happens when ownership changes. But if TikTok’s moves and policy changes continue to drive users away, it’s likely that the main beneficiary will be Instagram Reels.

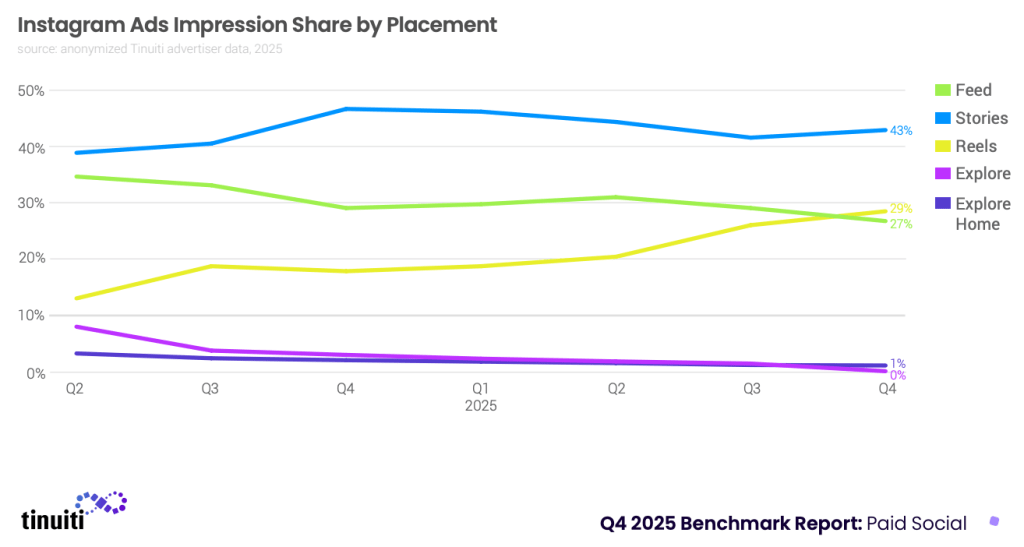

Tinuiti’s Q4 2025 benchmark report showed that ad impressions from Reels reached 29% during the final quarter of last year. While Meta’s CEO Mark Zuckerberg previously highlighted during his company’s Q3 2025 earnings call that Reels had achieved an annual run rate of $50 billion — the biggest amount of ad revenue for any short-form video format currently available.