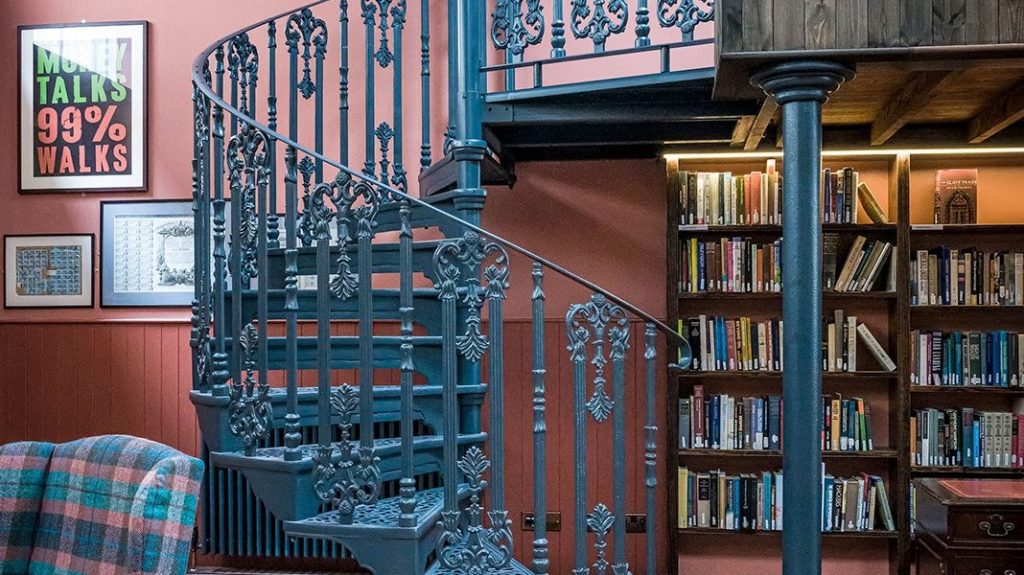

Down a narrow alley in Edinburgh, Scotland, there is a tiny library in an old, stone building. The single room houses about 4,000 books, most of them purchased second-hand, and all aiming to chronicle the history of business and finance. Its founder, Russell Napier, calls it the Library of Mistakes.

“All of us make decisions not knowing the future, and therefore we’re prone to mistakes…If we study these mistakes, we might be able to work out where they come from and create less of them,” says Napier, a financial advisor and a contributing columnist for the Toronto Star.

It’s the kind of approach that might have avoided trillions of dollars in losses over the course of centuries, up to the recent collapse of Terra, an algorithmic stable coin. This single incident cost investors $45 billion.

For Napier, the models and computer code that dominate the financial system now tend to obscure the lessons of history: “It’s a distillation. When you make whisky, you distill stuff and you throw the rest away. Well that’s what the mathematicians have done; they’ve distilled it, they’ve got this essence, and they’ve thrown the rest away. We’re trying to bring it back in.”

The financial cycle of mistakes

He founded the library eight years ago, inspired by a quote he found troubling: “Progress is cumulative in science and engineering, but cyclical in finance.”

“Why is this?” Napier says. ”It’s because people don’t know enough financial history, don’t study it, don’t read it.”

Working within the library’s collection, Napier teamed up with a group of academics tracing the history of books about beating the stock market. The researchers came up with a greatest hits list spanning almost three centuries—and found that stock market advice hasn’t changed much.

“[The market] is now an online, computerized, electronic kind of placeless thing…not men in breeches and wigs standing around in a courtyard in the Royal Exchange in London exchanging bits of paper,” says Paul Crosthwaite, senior lecturer in English at the University of Edinburgh, and one of the researchers. “Given how radically different those two markets look, it’s quite striking how similar the basic underlying advice is.”

Their review includes hundreds of books, a handful of which are highlighted here:

The guide stops at 2007. So what about the most recent stock market advice? Is it any different?

Crosthwaite refers to the modern movement as the “self-actualization of financial advice”. People are transferring financial advice to their personal lives, using the stock market as a model for how to conduct themselves: “You should be calculating, you should be thinking about risk and reward, value, all of these kinds of questions.”

He will be adding another volume to Napier’s library when his book, which collects all the team’s research on the history of stock market advice, comes out in November.

Another era that might warrant future examination: the crypto age.

“We’re not saying the past is better or worse,” says Napier about his library’s mission. “We’re just saying the past tells us something about how the system works.”