Summary:

- The Curve Finance community has released a proposal to remove UST pool gauges.

- The proposal argues that CRV should not incentivize UST pools as it will create a negative loop for CRV.

- There are six days left to vote for the proposal, and 100% of the Curve Finance community is for it.

- The value of UST is now trading around the $0.088 price after a local low of $0.0778

The Curve Finance DAO has initiated a proposal to remove all UST pool gauges. The proposal argues that Curve (CRV) should no longer incentivize UST pools as it will result in a negative feedback loop for the token. The team at Curve Finance announced the proposal earlier today using the following Tweet.

A proposal to stop all emissions to UST-related gauges (regardless on whether one weight-votes or not).

Good bye UST – it was a good experiment, but it didn’t work out: UST supply grew much larger than Luna liquidity which can absorb redemptions.https://t.co/eSQPnf4rTh

— Curve Finance (@CurveFinance) May 19, 2022

100% of the Votes Cast by the Curve Finance Community Are For the Proposal

The proposal further explains that UST’s value has dropped by 90%, and the Terra ecosystem has roughly $9 billion worth of bad debts. Additionally, it is clear that there is no ‘prospect of sustainable recovery of the peg.’

Furthermore, the proposal states that it is not yet clear ‘how exactly weaknesses were exploited and if these vulnerability vectors will persist even in the case of a successful bailout.’

The current situation also creates two problems for Curve Finance.

- Curve pools could be bribed with the sole intent of attracting exit liquidity for UST, thus soft-rugging new liquidity providers.

- Empty pools could consequently be occupied by entities seeking to extract value from the Curve DAO through CRV emissions. A liquidity provider could then proceed to only farm CRV and constantly vote or bribe the pool and not provide any value to the DAO in liquidity or volume. This scenario would be troublesome since UST has depegged significantly, allowing the malicious entity to deposit liquidity with an uneven distribution. This will prevent other LPs from entering the pool due to high slippage and/or provision of UST exit liquidity for the malicious entry.

At the time of writing, 100% of the votes cast by the Curve Finance community are for the proposal. Voting is also open for the next six days.

TerraUSD (UST) hits a New Low of $0.0778

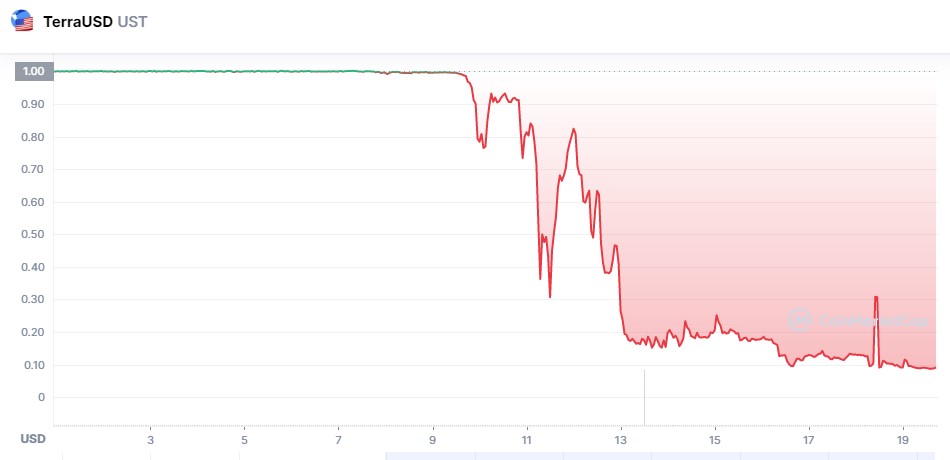

TerraUSD (UST) is trading at $0.088, signifying a 91.2% depegging from the $1 mark at the time of writing. Earlier today, the UST stablecoin hit a new low of $0.0778.

The chart below, courtesy of Coinmarketcap.com, further provides a visual cue of the severe situation surrounding the depegging of UST since the beginning of this month.