The concept of options trading has grown more viral than a few years ago. These days, retail investors capitalize on the rise of social media buzz and trading apps to partake in options trading.

Lithium recently invested in Buffer Finance, an options platform. Therefore, in this article, you will discover more about Buffer’s market analysis and solutions to current problems. Let’s first have a clear definition of what is option trading.

Options are contracts that provide a user the choice, but not the responsibility, to purchase or sell an asset at a specified price at or before the contract’s expiration date. Options are valuable because they can improve a user’s portfolio. In addition, options offer protection and leverage by increasing revenue for a user.

Trading Options in the Crypto Space

Options trading has enjoyed increased popularity in the crypto space. As a result, the volume of Bitcoin options traded over the last few years has surged. Therefore, this shows the warm reception the concept of options trading enjoys in the crypto market.

Moreover, Bitcoin and Ethereum are two crypto platforms whose options markets have grown dramatically in the last two years. So, there has been an open interest of over 500% rise in open interest in their market.

In addition, Bitcoin options hit an all-time high in late 2021, with a value of over $12 billion at the end of the year. However, there was a temporal decline from October 2021.

Buffer’s Analysis on Trading Options

Buffer Finance is a non-custodial, on-chain, bidirectional options trading protocol, that is heavily involved, is bridging the gap between trading options. Therefore, Buffer Finance has recently analyzed the market to show the growth rate of options trading in the crypto space. The analysis examined Ethereum and Bitcoin from 2020 to 2021.

Source: Buffer Finance

Although Bitcoin’s volume exceeds Ethereum’s, the latter’s growth was faster than the former. Ethereum had a 1,775% increase between July 2020 and December 2021. This shows a faster rise compared to Bitcoin’s 500% increase in its options trading. However, the current indications of market strength for Ethereum differ.

Also, people in the financial space mostly use derivatives. They serve a series of functions in the daily lives of users. These include checking accounts, mortgages, and insurance. Furthermore, derivatives protect financial downfalls. They allow hedging against price fluctuations and help cut down on risks and losses.

As a result, Buffer Finance has identified the following as key challenges it aims to tackle:

- Option mispricing.

- Capital withdrawals.

- Token/currency risk.

Options mispricing is one of the key challenges that Buffer aims to fix for its users. Therefore, Buffer provides a way out for liquidity pools to meet their obligations in the event of a shock. It established a “maximum payout” on all options. The “maximum payout” is set when the options are bought, ensuring that the total payoff never exceeds the overall liquidity pool.

Buffer’s Tokenomics

The Buffer ecosystem functions based on three distinct tokens:

- iBFR token– This is Buffer’s native token. Furthermore, users can stake the iBFR to farm the BFR token. Also,stakers of the $iBFR token will receive 50% of the revenue earned by the protocol.

- BFR token– This token is how Buffer generates revenue indefinitely. BFR is Buffer’s uncapped token. The BFR token price rises with the token’s supply.

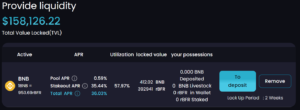

- rBFR token—Liquidity providers often receive this token. rBFR plays a lot of functions on the Buffer protocol. It earns a yield over provided liquidity.

Source: Buffer Finance

Finally, Buffer Finance is well-positioned to profit from the growing options trading in the crypto space. The platform has the infrastructure to be the next big thing in the crypto space.

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.