Beefy Finance keeps coming up with interesting farming strategies. Their latest vault has three stablecoins with a high yield. Beefy is a multichain DeFi yield optimizer. They built this vault on the Fantom chain. We’re talking about the TOR/USDC/DAI vault.

With their compounding farming strategies, yields are high on Beefy Finance. Let’s dive in and see how they do this.

Is the #StableCoin panic over?

Because, you know..

There is a nice $TOR/ $USDC/ $DAI Stable farming here!https://t.co/q1m0dsuXF9Don’t forget $TOR is Fully Backed by $HEC Treasury

Happy Farming!#cryptotrading #cryptotwitter #Cryptos #CryptocurrencyNews #crypto pic.twitter.com/lUBiVrnu0I— Hector Finance (@HectorDAO_HEC) May 18, 2022

What Is Beefy Finance?

Beefy Finance is a yield optimizer that works with vaults. They take all or most of the hard work out of your hands. This is how they do it.

- You invest a certain amount in a Beefy vault.

- Beefy now starts a complex yield earning strategy with your investment.

- This involves an automated process. For instance, they invest and reinvest your funds all the time. This way they get a high compounded interest for you.

- As a result, you save on all the transactions that this strategy involves and the associated gas fees.

- This gives you time to find more interesting strategies.

In these vaults, you earn rewards in the form of your staked assets. So, in case of the 3-pool vault, you earn more TOR, USDC, and DAI. Despite it being a vault, you can take out your deposit any time. However, Beefy vaults work best for the medium to long term. This way you get most out of the compounding.

What Is the TOR Stablecoin?

The TOR stablecoin lives on the Fantom Opera blockchain. The Hector Treasury backs this stablecoin with collateral. It pegs to the US dollar 1:1.

It is part of the Hector Finance project, which also supports the HEC token. HEC and TOR, rings a bell, Hector? Whenever they mint TOR, they burn the HEC token. Hector has a smart contract protocol that controls that TOR remains pegged to the USD.

Now, Hector started a new vault of TOR/USDC/DAI in a Beefy Finance vault. Let’s take a look at how this works and what the yield is.

The TOR/USDC/DAI Beefy Vault

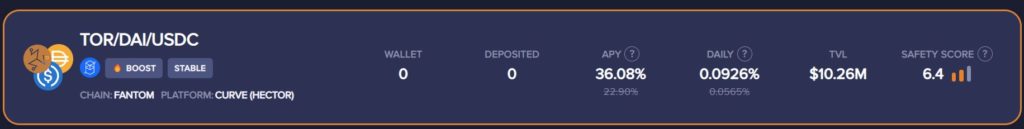

The newly created TOR/USDC/DAI vault gives at the time of writing a 28.54% yield. However, be aware that this percentage changes all the time. At the same moment, it has $8.76 million in TVL. The screenshot below is from a few days ago. As a result, there are different numbers in it for yield % and TVL.

Source: Beefy Finance app

To join this vault;

- Visit the Beefy Finance website.

- Connect your wallet to the Fantom chain and select the Curve (Hector) network. We explained how to do this in this article. Each vault, on the Beefy website, will tell you which chain and network to use.

- You can take your deposit out at any time, and you will receive that together with your compounded yield.

Conclusion

We showed you how to join the TOR/USDC/DAI vault on Beefy Finance. We also gave some background information on Beefy and the TOR stablecoin. Beefy vaults are great because they take all the hard work out of your hands. In the meantime, Beefy looks for the best yields available on the market.

Beefy Finance has a great quote for this: “Sit back and relax, the vault does all the work for you.” A remarkable and easy way to collect passive income.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.