- Solana has dropped 18.2% after being rejected at the $190 resistance over the last four days.

- Metrics signaled a potential bullish reversal.

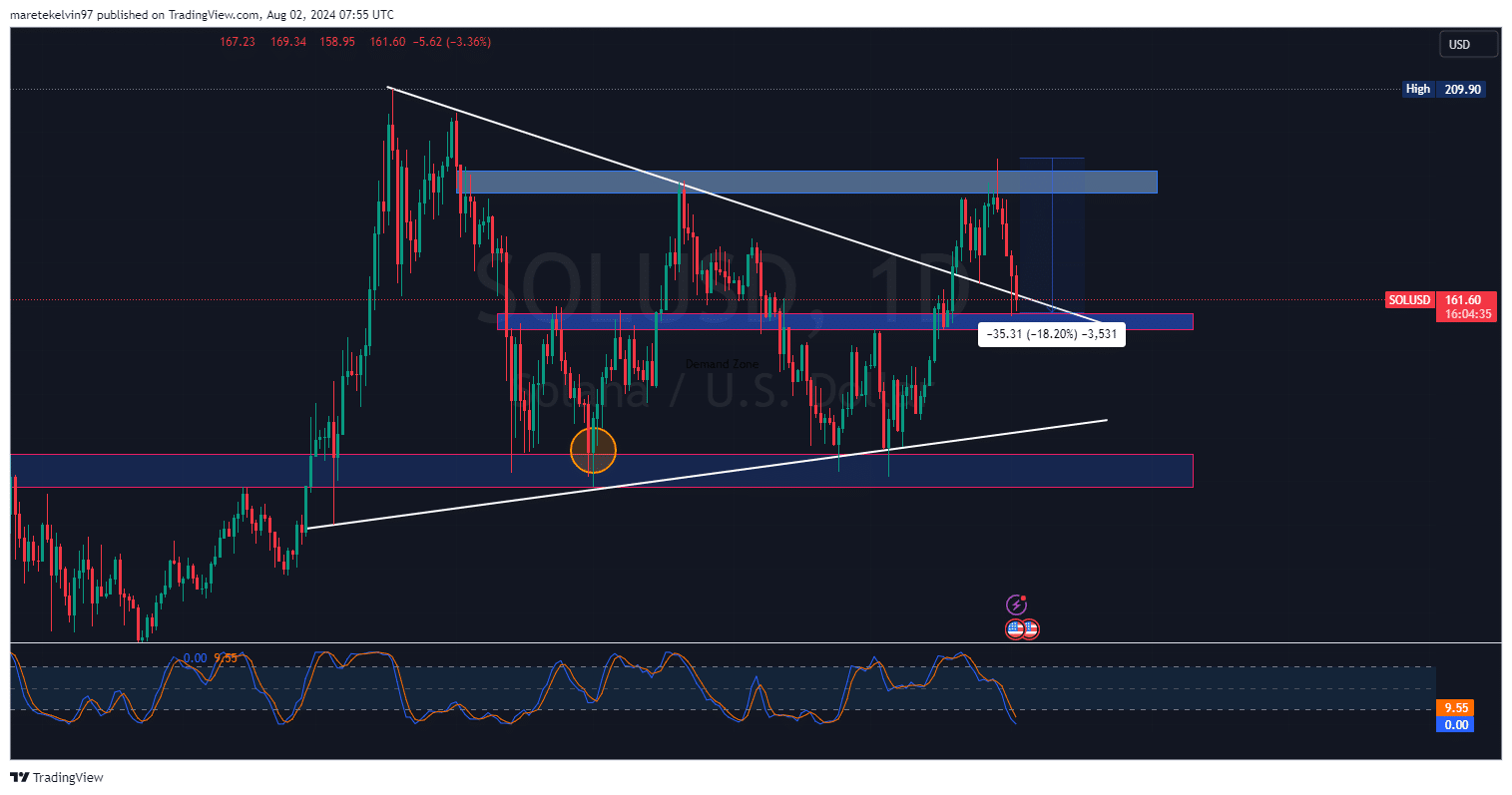

Solana [SOL] has faced a sharp decline, dipping by about 18% in value over the last four days. This bearish downturn comes after a rejection at the $190 resistance level.

The rejection ended a previous bullish rally, leading to a bearish run that is currently testing the resilience of the Solana support level of $160 at press time.

This support level aligned with the symmetrical triangle pattern, confluencing at around $160.

It is worth noting that the symmetrical triangle pattern sometimes indicates a continuation or reversal, depending on which way it breaks out.

The convergence of the triangle’s resistance with the support level makes this area especially important. A break below may signal more downside potential, while a bounce could suggest an impending reversal.

Source: TradingView

Bullish signs ahead?

Although we have seen a lot of bears lately, it seems that there may be something bullish brewing.

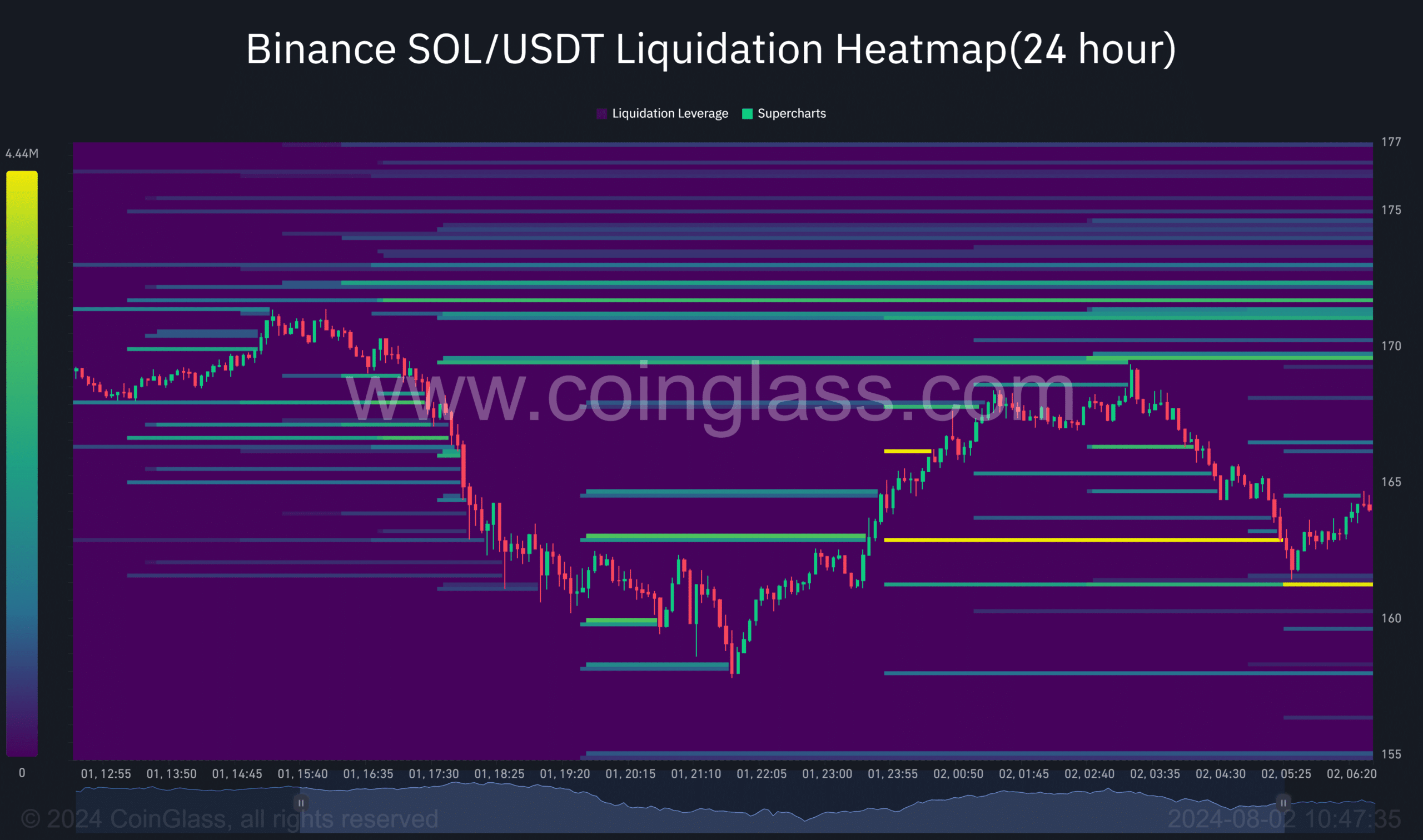

This comes after a big market liquidation where $3.71 million worth of positions were cleared at the $161 price point, according to Coinglass data.

Historically, when this happens, selling pressure is exhausted and over-leveraged bearish investors are being taken out of the market. This creates room for new buyers to enter, which could result in prices bouncing back.

Source: Coinglass

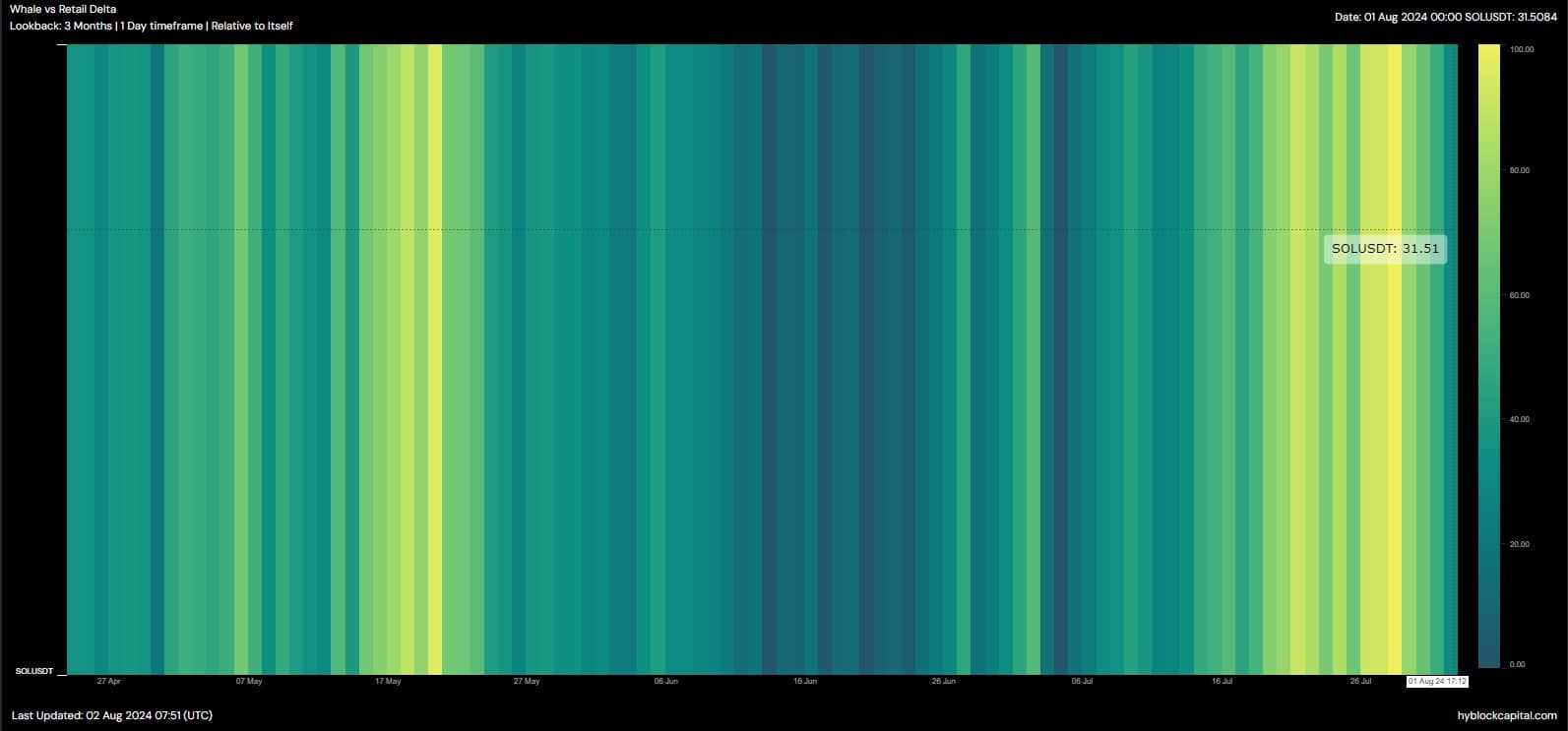

Solana whale dominance

According to Hyblock data, 31.51% of Solana is held by whales. This indicated that these large investors controlled a significant amount of the total supply compared to smaller retail investors.

This kind of concentration often leads to more volatile price action.

Source: Hyblock

Realistic or not, here’s SOL’s market cap in BTC’s terms

Solana is in the middle of a make-or-break period. The recent test of the symmetrical triangle support line at $160, paired with liquidation and high whale activity, can give way to increased price fluctuation.

A break could mean a more bearish run, while a price reversal might indicate a potential bullish rally.