- Euro meets temporary support near 1.0940 against the US Dollar.

- Stocks in Europe keep the bearish note unchanged so far on Friday.

- EUR/USD bouncess off three-week lows in the vicinity of 1.0940.

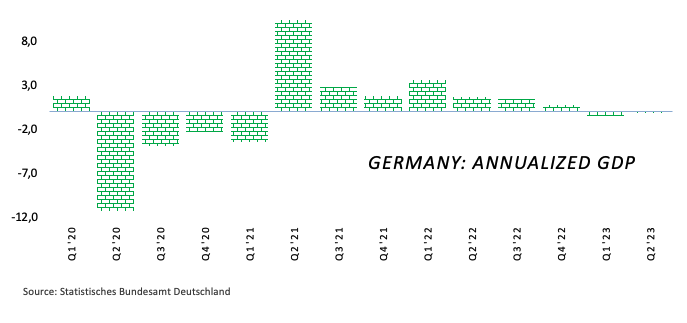

- Flash Q2 GDP Growth Rate in Germany missed expectations.

- Investors’ attention remains on flash Germany’s CPI, US PCE.

The Euro (EUR) manages to regain some balance and trim initial losses against the US Dollar (USD) as the week comes to a close, resulting in EUR/USD rebounding and approaching the psychological barrier at 1.1000 the figure.

The earlier rapid decline in the pair gained momentum after the European Central Bank (ECB) decided to raise its policy rates by 25 bps on Thursday. This decision came together with a dovish message, as the bank indicated the possibility of a pause in its rate-hiking cycle as early as the September meeting. The ECB also painted a less-optimistic picture regarding the economic outlook for the region.

Regarding the potential rate pause, President Christine Lagarde appears to have reinforced this view by suggesting an “open-minded” approach to the September meeting. She also emphasized that future rate decisions will depend on economic data.

As the Euro reverses the initial pullback, the US Dollar Index (DXY) faces some pressure after climbing to new multi-day highs in the 102.00 neighbourhood. The knee-jerk in the index comes pari passu with the U-turn in US yields across the curve, which now trade with small losses across all maturities.

On the domestic front, preliminary GDP figures in Germany indicate a 0.2% YoY contraction in the economy for the April-June period, while the final Consumer Confidence data for the broader euro area matched the initial estimate at -15.1 for the current month. Later in the session, advanced inflation figures are expected to be released for Germany.

In the US, all eyes are on the release of inflation figures, measured by the PCE and Core PCE. Additionally, other crucial data to be released includes Personal Income, Personal Spending, Employment Costs Index, and the final Michigan Consumer Sentiment gauge.

Daily digest market movers: Euro bounces off lows near 1.0940

- The EUR looks to retake the 1.1000 hurdle against the USD.

- The USD Index falters around the 102.00 yardstick.

- German preliminary Q2 GDP figures disappoint.

- US, German 10-year yields reverse the initial uptick.

- Investors’ focus will be on German CPI, US PCE.

- The BoJ surprises everybody after tweaking its yield-curve-control stance.

- ECB’s Simkus, Vasle suggested a pause in September is an option.

- ECB’s SPF sees inflation barely changed in the next three years.

Technical Analysis: Euro still risks extra losses

EUR/USD breaks below the 1.1000 key support with apparent determination, suggesting that a potential deeper pullback is in store in the short-term horizon.

If bears push harder, EUR/USD should meet immediate contention at the temporary 55-day and 100-day SMAs at 1.0905 and 1.0902, respectively. The loss of this region could open the door to a potential visit to the July 6 low of 1.0833 ahead of the key 200-day SMA at 1.0717 and the May 31 low of 1.0635. South from here emerges the March 15 low of 1.0516 before the 2023 low of 1.0481 on January 6.

On the other hand, occasional bullish attempts could motivate the pair to challenge the 2023 high at 1.1275 recorded on July 18. Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 on February 10, which is closely followed by the round level of 1.1500.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.