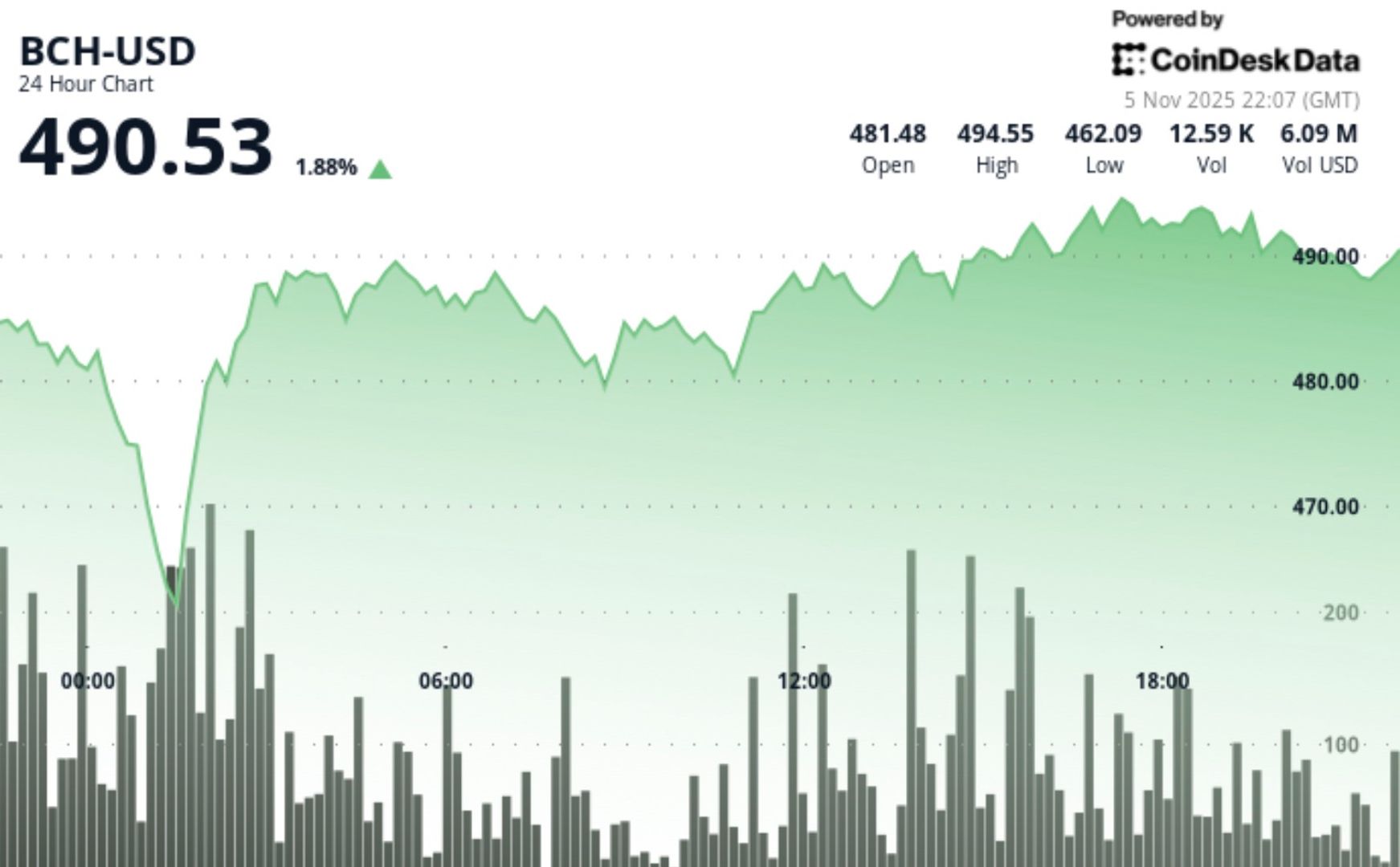

European session buying lifted volume 78% above the 24-hour average as bitcoin cash set higher lows at $462.67, $474.27 and $479.03.

Updated Nov 5, 2025, 10:30 p.m. Published Nov 5, 2025, 10:20 p.m.

What to know:

- Breakout above $487 occurred during the European session on sustained buying, sending BCH up 3.3% to $491.80.

- Volume peaked at 33,795 units on Nov. 4 at 21:00, 78% above the 24-hour average of 13,478.

- Resistance formed near $495 including a $495.30 session high, while support sits at $490, $487 and $479.03.

According to CoinDesk Research’s technical analysis data model, BCH rose 3.3% to $491.80 after clearing $487 on above-average European session volume, posting a $33.36 range and a brief pullback from a $495.30 high that buyers quickly faded.

(Please note all timestamps are in UTC.)

Technical analysis highlights

- Price moved from $476.10 to $491.80, up 3.3%

- Intraday range measured $33.36

- Higher lows were set at $462.67, $474.27 and $479.03

- Breakout above $487.00 occurred during the European session on sustained buying interest

- Price peaked at $495.30, then slipped $3.20 to $490.14 before rebounding to $492.99

- Multiple attempts to breach $495.00 took place between 16:00 and 17:00 on Nov. 5

- Volume peaked at 33,795 units on Nov. 4 at 21:00, versus a 24-hour average of 13,478 units, a 78% surge

- The 0.65% pullback from session highs was followed by recovery above $491.00

Patterns explained

The report describes an ascending trend with a clean breakout: buyers repeatedly stepped in at progressively higher lows, price pushed through $487 with stronger participation, then a small dip was absorbed quickly, which kept momentum intact.

Support vs. resistance map

- Support: $490.00 psychological level tested during a 60-minute correction; $487.00 breakout zone; $479.03 higher low

- Resistance: $495.00 area after several rejections; $495.30 session high

Targets & risk framing

- Targets: Immediate upside target at $495.30 with breakout potential above $500.00

- Invalidation/risk: Defend $487.00 to maintain the bullish structure

- Context: Risk/reward favors continuation with a 7.0% daily range indicating strong volatility

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Higit pang Para sa Iyo

Inside Zcash: Encrypted Money at Planetary Scale

A deep dive into Zcash’s zero-knowledge architecture, shielded transaction growth, and its path to becoming encrypted Bitcoin at scale.

Ano ang dapat malaman:

In 2025, Zcash evolved from niche privacy tech into a functioning encrypted-money network:

- Shielded adoption surged, with 20–25% of circulating ZEC now held in encrypted addresses and 30% of transactions involving the shielded pool.

- The Zashi wallet made shielded transfers the default, pushing privacy from optional to standard practice.

- Project Tachyon, led by Sean Bowe, aims to boost throughput to thousands of private transactions per second.

- Zcash surpassed Monero in market share, becoming the largest privacy-focused cryptocurrency by capitalization.

More For You

Robinhood’s Crypto Trading Revenue Soared 339% in Q3 as Company Tops Street Earnings Estimates

The brokerage platform saw a record $80B in crypto trading volume; shares dipped in after hours action despite the earnings beat.

What to know:

- Robinhood’s crypto trading revenue surged over 300% in the third quarter, hitting $268M.

- The company processed $80B in crypto volume and added new business lines like prediction markets and Bitstamp.

- Shares are lower despite the earnings beat, but remain sharply higher for the year.