Pound falls to nine-week low, UK food inflation jumps

The British pound is down for a fourth straight day, as the US dollar is showing strength against most of the majors. The pound has declined 1.5% in the current slide.

In the European session, GBP/USD is trading at 1.3338, down 0.10% on the day. The pound fell as low as 1.3315 earlier, its lowest level since May 19. UK inflation has been going up, so it was no surprise that the British Retail Consortium (BRC) Shop Price Index jumped 0.7% in July, up sharply from 0.4% in June and above the forecast of 0.2%. Read more…

GBP/USD Forecast: Pound Sterling remains bearish despite recent rebound

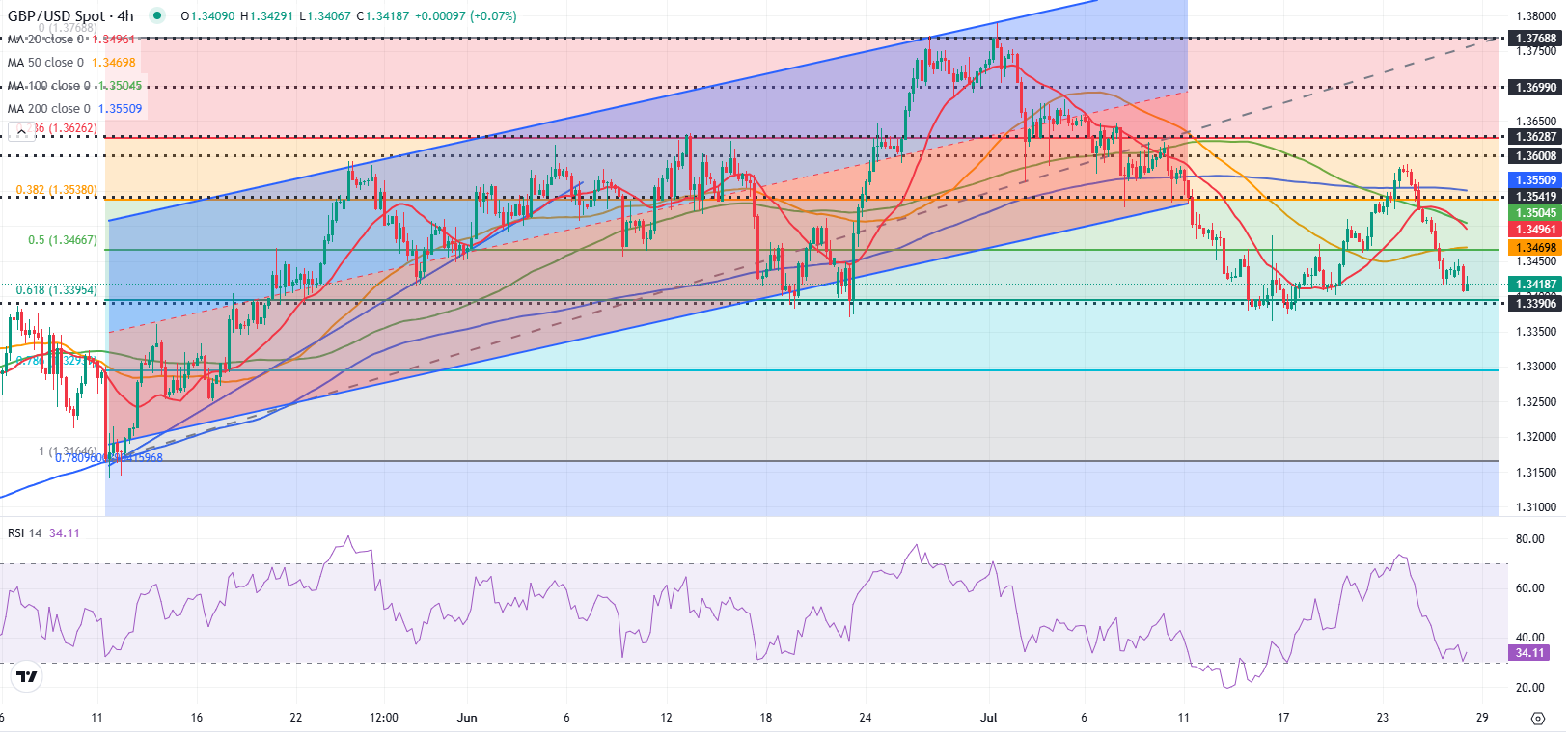

GBP/USD trades slightly above 1.3350 after having touched its weakest level since late May below 1.3320 earlier in the day. The pair’s technical picture points to oversold conditions, suggesting that there could be a correction before the next leg lower.

The US Dollar (USD) started the week on a bullish note and caused GBP/USD to turn south on Monday, as investors’ concerns over an economic downturn in the United States (US) eased after the US reached a trade deal with the European Union (EU). Read more…

GBP/USD Forecast: Pound Sterling remains vulnerable on broad USD strength

After posting large losses on Thursday and Friday, GBP/USD struggles to stage a rebound on Monday and trades in negative territory, slightly above 1.3400. The pair’s technical outlook suggests that the bearish bias remains intact in the short term.

The US Dollar (USD) outperforms its rivals as fears over an economic downturn in the United States (US) ease. The European Union (EU) and the US announced over the weekend that they have reached a framework trade deal that sets a blanket 15% tariff on goods traded between them. Additionally, European Commission President Ursula von der Leyen noted that they will not impose retaliatory tariffs and said they will invest $600 billion in the US on top of existing expenditures. Read more…

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.